Horizon Finance Group Personal Loans

Table of ContentsTruck Finance BrokerHorizon Finance Group Equipment Finance

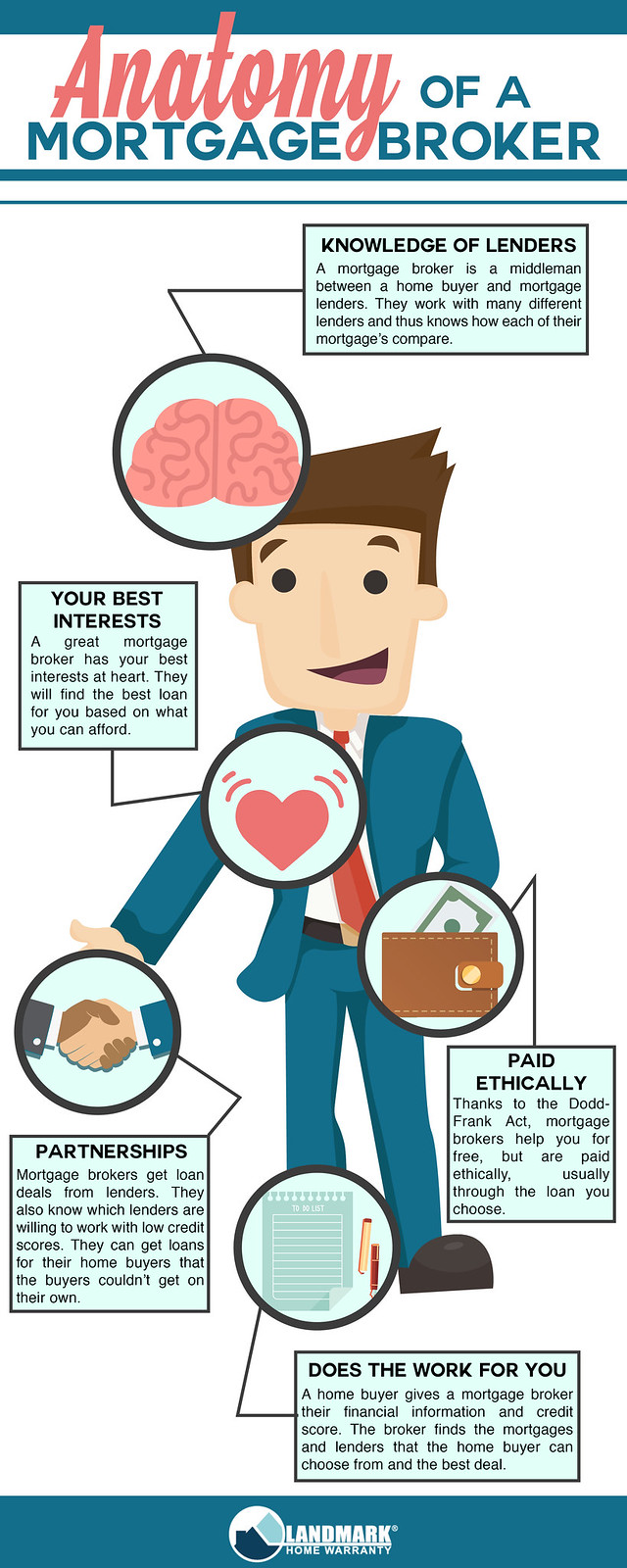

sector associations. Kick back. It is not as complicated as it sounds. If you are checking out a career as a finance broker, right here is what you require to recognize. Financing brokers likewise have close connections to developing cultures, banks, as well as other borrowing institutions as well as can get in touch with them to find you the most effective feasible bargain. Horizon Finance Group Car Finance Broker. Money brokers additionally have specializeds, such as trading supplies and also various other assets like minerals and also steels. These kinds of money brokers do the job to bargain the ideal rates for you. Money brokers manage numerous economic items, such as insurance coverage as well as home mortgages, supplies and auto as well as individual financings. Considering that these are their locations of know-how, economic brokers generally have.

mild variants in their jobs from everyday, though generally, lots of have comparable roles. The more typical duties of financial brokers include, yet are not restricted to: drawing in clients though marketing and networking; meeting customers to speak about their financial items or investment requirements; preparing records on clients'monetary scenarios and also recommending methods to boost or maintain their condition; suggesting and supporting clients with economic decision-making via life changes like marital relationship, divorce, or retired life; making use of software, documents, or other devices to brush via hundreds of items to match with their customers 'needs; talking with banks or insurance policy suppliers about their customers 'demands and also wrapping up the most effective prepare for all celebrations; arranging the documentation as well as talking with the relevant legal entities up until the loan or policy is passed; and guaranteeing that all insurances, loans, and also contracts stick to present federal as well as state regulations and laws. If you intend to come to be a money broker, you will certainly require to get a tertiary credentials. You can begin this procedure by finishing Year 12 studies either with attending high college or finishing an equal training course at a different school. You might also take into consideration finishing a tertiary preparation certificate if you intend to alter occupations and have not participated in official education in a variety of years. This action is optional in your quest to end up being a finance broker. Popular organizations in Australia include the Financial Providers Institute of Australasia, the Home Loan as well as Money Organization of Australia, and also Financing Brokers Association of. Horizon Finance Group Car Finance Broker.

can contrast the products available to provide a selection that really matches the demands of their customer; they generally simplify the mortgage process, a complex and also often unusual procedure, for their client. They have the ability to finish much of the documents, working very closely with their customers to collect the called for supporting documentation, send the application to the proper lender, and also handle the process with to settlement. Q. With the bulk of possible property buyers incorrectly believing brokers charge a fee for solution, just how are brokers really paid? A. Compensations as well as charges vary from lender to lender. If you are worried about the payments your broker may be making, ask them ahead of time they are required to disclose any type of commissions they might be gaining to prevent any kind of conflict of rate of interest. Q. How do potential buyers discover a broker? A. There are several ways to discover a broker.

Horizon Finance Group Adelaide

Alternatively, you can meet a few brokers as well as pick the one that finest suits you. The broker you select ought to belong to an industry body such as the FBAA. They must also be accredited under the National Customer Credit Scores Defense Act as well as have a Certification IV, ideally a browse around this web-site Diploma in Financial Services Mortgage Broking. The recent research study suggests 43%of prospective buyers are searching talking to greater than one broker during the mortgage process. Why do you believe this may be the situation? A. Customers are seeking a broker that offers excellent personal solution as well as provides on their guarantees. They need to be able to feel they can rely on the individual that is going to help them with the most significant financial commitment

brokerage company. They this page will certainly function as a center man in between those looking for a finance and also the car loan service providers. They'll accumulate details on your business and with your authorization put on bank loan providers on your behalf - Horizon Finance Group Truck Finance Broker. Most notably a good broker will talk with a much larger number of finance service providers than probably you would do straight as well as conserve company owner priceless time in relating to several loan companies themselves. If you are eager to use a bank rather of the lots of professional loan companies that are now found in Australia, after that great brokers ought to have connections with financial institutions also. A transparent broker ought to educate you of the rate of interest offered by the lending provider and also their markup as well. If you're in talks.